Bitcoin’s price has risen stratospherically, a fact that leaves many minor players in the market with massive gains and many bigger players millionaires. But is this a bubble? Are the gains real? And are the bitcoin whales in for a sad Christmas?

First we must understand what drives bitcoin price and, in particular, this boom. The common understanding for current growth leads us back to institutional investors preparing for the forthcoming BTC futures exchanges.

The primary theory about the astonishing rally being put forward by investors on social media is that bitcoin will soon benefit from big institutional money injections via the introduction of the first BTC futures products. CBOE Global Markets and CME Group are launching new futures contracts on December 10 and December 17, allowing investors to go long or short on bitcoin. This ability makes bitcoin far more palatable to big investors who are currently flooding the market to make profits if and when the bitcoin price falls.

This move also legitimizes bitcoin in Wall Street’s eyes, an important point considering cryptocurrencies are still suspect.

Further growth comes from the “bitcoin as a store of value” crowd. This group of enthusiasts bought and held bitcoin and will not sell it at any current price. More and more bitcoin fans are entering into this group and they are driving up demand increases. In a world where people expect bitcoin to be worth $1 million soon this sort of activity – whether rational or irrational – is quite popular.

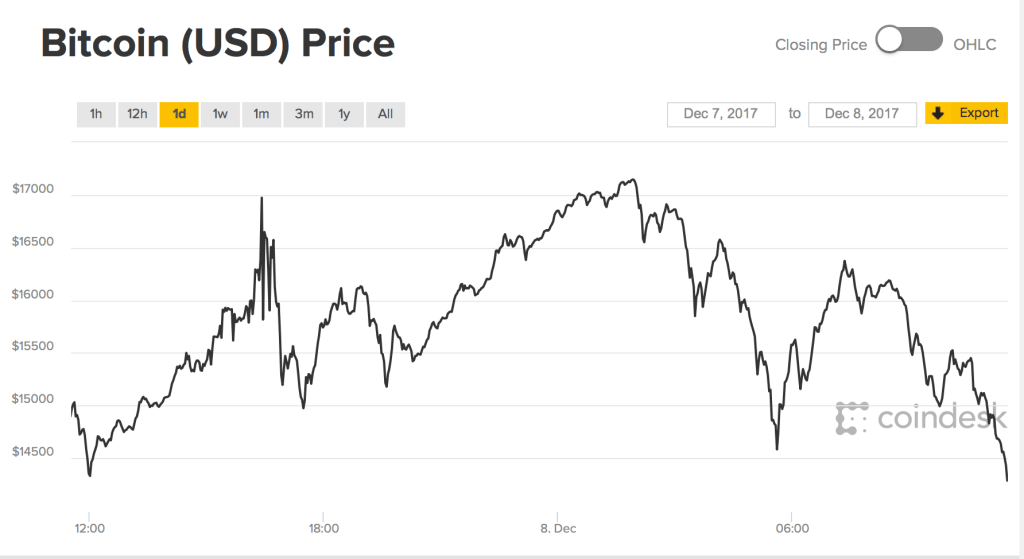

We see a common thread between these points: hype and news. All cryptocurrency movements are based on domain specific media and conversations between traders. Bitcoin traders, it can be said, are now akin to the jolly colonists selling stocks under buttonwood tree. This small but influential market is prone to panics based on a single tweet and users work together to at least bolster themselves with cries of “HODL!” The market is so nascent that there are no dark pools, no popular algorithmic trading systems, and no real way to automate your buying and selling activities (although, without futures, there was never a need to). That is all coming and at that point the market will harden itself against panics and booms. Until then we enjoy rises and dips and volatility that puts most bitcoin dilettantes off their lunch.

Ultimately new and old users are testing the limits of a system that, for a decade, has been untested. The futures market will be a big driver in growth and bust over the next few months as institutional investors begin using the currency. CoinDesk writer Omkar Godbole notes that the price should remain stable but “a pullback to $11,000 cannot be ruled out, but dips below the upward sloping 10-day MA of $11,500 are likely to be short-lived.”

“As of now, a significant correction is unlikely and could be seen only on confirmation of a bearish price-RSI divergence and/or if RSI and stochastic move lower from the overbought territory,” he wrote.

Is this dangerous? Yes, to those who are betting big on BTC. Again, I cannot tell you whether to buy or sell but the common expectation is that bitcoin raises to a set point and then fluctuates between a high and a low until the next run up. Many expect foul play.

“The current price isn’t truly driven by demand. When CME Group went live with Bitcoin futures we saw a sharp increase in demand and an increased number of users in the network,” said Matthew Unger, CEO and Founder of iComplyICO. “Now, some institutional major players are flooding the network with new cash and creating what appears to be market manipulation. Now that Bitcoin futures are available it is easy to buy into futures market first and then create a massive number of buys or sells of Bitcoin to ensure the price swings in favour of your futures contract.”

“In many jurisdictions, Bitcoin has yet to become subject to regulations, leaving an investor with no recourse or protection from fraud or market manipulation,” said Unger.

Is this a bubble? Many are disappointed in the moves, believing the rise is happening because of market manipulation. But we must remember that the real value of a cryptocurrency is not driven by price but instead is driven by utility. While bitcoin may always be the proverbial hidden pot of gold for early buyers the future of all cryptocurrencies is still being written. Just as, in 1994, no one could have predicted the prevalence and value of open source projects like Linux and Apache, no one can currently predict what bitcoin and other cryptocurrencies will do for us in the future. Until we know, it’s best to buckle up and enjoy the ride.

Source: Techcrunch

Comments